Focused on four sectors in Istanbul

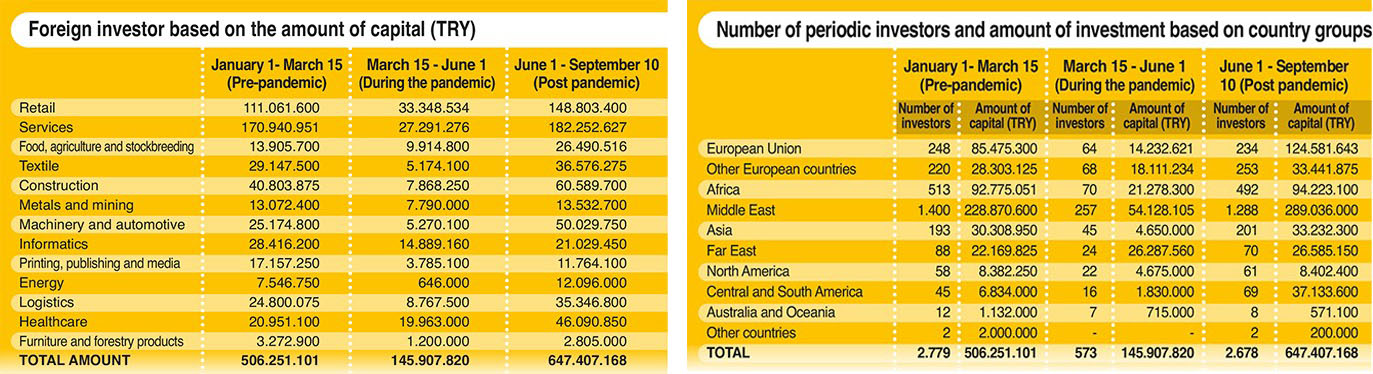

During the launch of the normalization process in Istanbul in June 1 - September 10, 2 thousand 678 foreign investors founded companies with a capital of TRY647.4 million.

During this period, foreign investors mainly invested in services, retail, construction and machinery-automotive sectors.

Middle Eastern and European companies engaged in the services sectors, African companies, on the other hand, preferred the retails.

THE number of companies established in Istanbul with foreign partners and the amount of capital achieved a ‘V-shaped recovery’ upon the launch of the normalization process on June 1. According to the ‘Report on the State of Periodic Foreign Investors in Pre-Pandemic and Post-Pandemic Periods’ prepared by the Statistics Unit of Istanbul Chamber of Commerce’s Economic and Social Researches Directorate, 2 thousand 779 foreign investors placed a total amount of TRY506 million 251 thousand 101 in Istanbul during the pre-pandemic period in January 1 - March 15, 2020.

In parallel with the slowdown in the economic activities in the March 15-June 1 period when Covid-19 was identified as a pandemic, the rate of new foreign investments decreased. In this period, the assets of 573 foreign investors reached TRY145 million 907 thousand 280.

TRY647 MILLION INVESTED

In June 1 – September 10, 2020, regarded as the beginning of the normalization process, the desire to make new investments returned to its pre-pandemic level and 2 thousand 678 foreign investors established new companies with a total capital of TRY647 million 407 thousand 168. The sectors to receive the highest amount of investments from foreign investors in this period have been the services, retails, construction and machinery-automotive sectors.

RETAILS ON TOP OF THE LIST

Retails and services sectors maintained their ranks as the sectors with the highest level of investment in the first nine months of 2020. Construction and textile followed these sectors in the pre-pandemic period. With the emergence of the pandemic, foreign investors started to focus on the healthcare and informatics sectors as the third and fourth sectors. Their focus returned to construction and machinery-automotive investments in the post-pandemic period rather than healthcare and informatics areas.

343 PERCENT INCREASE IN CAPITAL

Compared with the pandemic period, 343 percent increase has been accomplished in capital value during the normalization period. With a 367.36 percent increase in the number of foreign investors, the figures of the pre-pandemic period have been achieved. In terms of the number of investors, Syria, Iran, Iraq, Jordan and Pakistan remained near the top in this period. Regarding capital value, Syria, Iran, Germany, Iraq and United Kingdom remained at the top five ranks of the list.

MIDDLE EAST AND EU INVESTS IN SERVICES

During the normalization period, countries of the Middle East and European Union mainly invested in Istanbul’s services sector. African countries invested mostly in the retails sector.

80% ARE LIMITED LIABILITY COMPANIE

Foreign capital companies registering into the Istanbul Chamber of Commerce mostly prefer the limited liability company status. This data remained unchanged before the pandemic and post-pandemic periods. Eighty percent of the newly founded companies are in the limited liability company category.